WHAT IS ACCOUNT RECEIVABLE IN MEDICAL BILLING?

As a healthcare provider, you may understand that an increase in A/R days will impact your bottom line directly. Now coping with the changing landscape of the medical industry era and high operational cost managing AR has become a herculean task for providers. But do you know what A/R stands for or how it works?

In simplest word, Accounts receivable (A/R) is the money owed to a business by its customers. In medical billing, it refers patient out-of-pocket payments and pending insurance reimbursements. Account Receivable involves following up with patients or insurers as well as to the insurance companies to ensure timely payment of all outstanding bills/claims.

In medical practices, it is become very important to track the age or time since each bill was sent (either to patient or insurance). This is known as days in AR (DAR). The higher DAR indicates problems in RCM process. It includes: claims rejection, delayed payments, higher ratio of denied claims. On the flip side, the lower DAR represents effectiveness of billing process. Meaning, payment is coming on timely manner.

Why is managing A/R important?

Managing A/R effectively can significantly improve the financial health of your practice. A well-managed A/R process can result in increased cash flow, double work, reduced overhead costs, and strengthen relationship with the patient.

It is very important to have efficient system to track payments, follow up on unpaid or pending claims, work on denied claims to get them paid, resolving rejections, and tackle any other issues which can delay payment collections. This is very complex process and it requires substantial time and resources to manage A/R process effectively. Which is usually not possible by any medical practices to have in-house.

How to measure A/R in healthcare practice?

Measuring accounts receivable (A/R) is crucial for healthcare practices to understand their financial health. To measure A/R, healthcare providers can use the following formula:

A/R = (Total Charges – Payments) + Adjustments

By measuring A/R, healthcare providers can identify trends and potential issues, like delay in payment collection from insurance companies or patients, and then take action to improve their revenue cycle management.

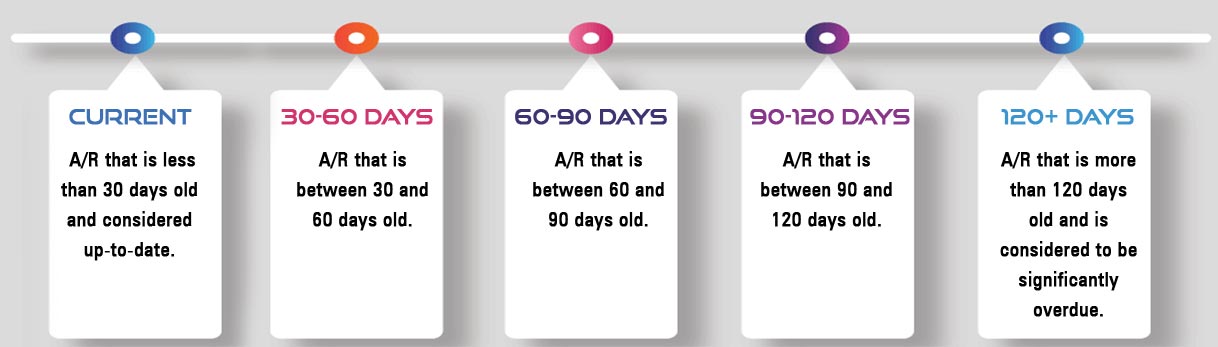

Classification of A/R in terms of ageing:

Accounts receivable (A/R) can be classified in terms of aging based on the length of time that they have been outstanding. A common way to classify A/R is to group them into different categories based on the number of days they have been outstanding. The categories are typically broken down as follows:

Why Providers Should Consider Outsourcing A/R Management Services

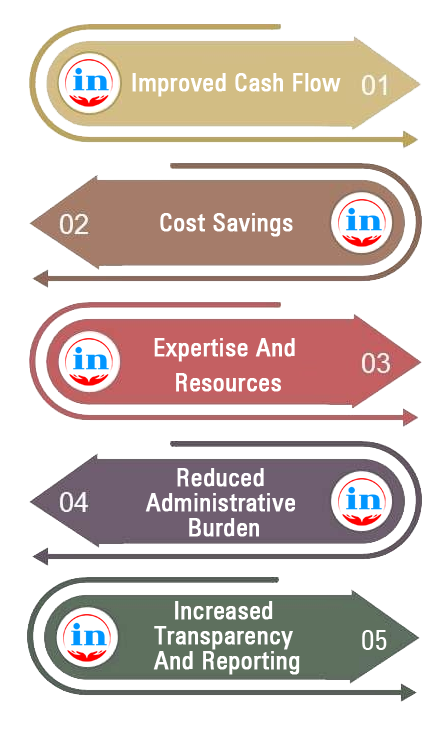

Outsourcing accounts receivable (A/R) management services is providing many benefits to the healthcare providers. Here are some reasons why providers should consider outsourcing A/R management:

Improved cash flow: A/R management services can help providers collect payments faster and reduce the number of days outstanding, resulting in improved cash flow and increased revenue.

Cost savings: Outsourcing A/R management can be more cost-effective than hiring and training in-house staff to manage it. Providers can save on salaries, benefits, and other overhead costs associated with hiring additional staff.

Expertise and resources: A/R management companies have specialized expertise and resources in revenue cycle management. They stay up-to-date with industry regulations and best practices and have access to the latest technology and software.

Reduced administrative burden: A/R management can be a time-consuming and complex process. Outsourcing it to a billing company can free up providers’ time and resources to focus on patient care and other critical aspects of their practice.

Increased transparency and reporting: A/R management companies provide regular reports and analytics to help providers monitor their financial performance and identify opportunities for improvement.

Outsourcing A/R management services allow healthcare providers to improve their financial performance, reduce administrative burden, and focus on delivering high-quality patient care. You will get all of these at Ingenious outsourcing as well.

How to reduce you legacy A/R?

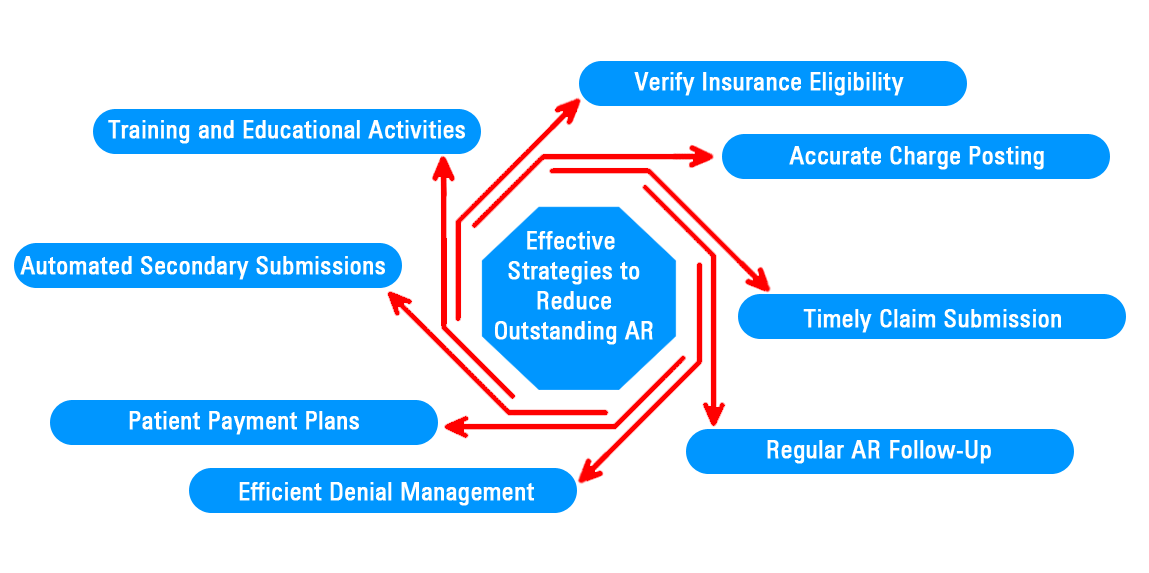

Reducing A/R in medical billing involves streamlining processes and enhancing efficiency to ensure quicker payments. By implementing best practices, medical practices can minimize the time spent on unpaid invoices and improve cash flow. At Ingenious outsourcing we have implemented some strategies which are very effective and proven to reduce outstanding A/R. Below are the list of strategies we follow:

- We are making sure that eligibility and benefits are verified accurately and prior to claim submission

- We are paying close attention during charge posting to enter them accurately. If we found out that the provided dx-code is not valid based on ICD-10 DATA or required modifier is missing or Primary CPT code is missing, etcetera, then we are reaching out to providers or practice manages to make corrections before it was billed to the insurance companies.

- We have prepared list of Timely Filling Limit of each insurance for to submit claims. And we always make sure that insurance company receive claim before the deadline.

- Regular AR follow-up helps practice to identify possible payments and denials. This way we can filter out the denied claim to focus more.

- We have separate denial management team to look after denied claims. They are not only working on denial, but also fixing them to not having same denial again.

- Some of the claims are paid by the insurance, but open for patient payment. So, we have a team who is doing soft phone calls to the patient to remind that their payment is due. In addition, we help provides to setup gateway to receive patient payment.

- For Secondary and Tertiary billing, we always believe in automation. Meaning, once the Primary payment is applied and if patient is having Secondary insurance, in that case, claims should be automatically transmitted to them, instead of waiting for monthly report to be generated and submit them manually.

- If any software does not allow us to transmit automatically, in that case, we have created extremely well coordination between posting team and billing team. As soon as posting team encounter that patient is having Secondary and Primary already paid, they are forwarding those claims to billing department. So, on the same day or very next day claims are submitted to the Secondary payer / Tertiary payer.

- Our team is well aware about the tools like fax, emails, and paper submissions. So, that we can use the best method to submit your claims.

- Continuous improvement is out motive. So, we are arranging regular training and educational activities, so that they are up-to date with the latest insurance policies and updates in Medical Billing.

So, we are here to reduce your legacy A/R as well as we are well prepared to take all of your tension related to A/R. Once you outsource A/R services from Ingenious Outsourcing, you will see drastic reduction into your older A/R. You will definitely see sharp improvement into your monthly collected revenue. So, why wait? Just put you’re A/R into the safe hands.